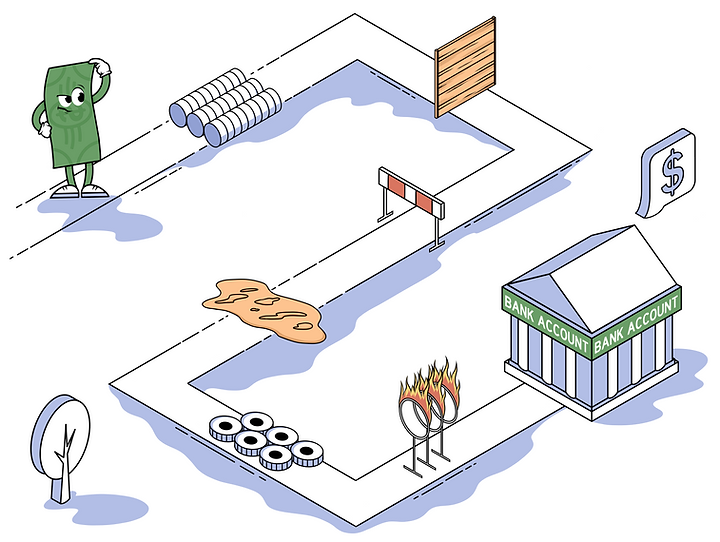

After you sell one of your products or perform a service, what do you do next?

If it’s waiting for payment, you’re not alone. Many owners face cash flow obstacles in their business – including not getting paid on time. When left unaddressed, these can negatively affect both daily and long-term operations.

That’s because sufficient cash flow entering your business is key to its success. It helps you handle short-term emergencies, plays a part in whether you get approved for a bank loan, helps create a healthy, sustainable operation, and determines your company’s value.

Some small things – like manual invoicing and lack of follow-ups – seem insignificant at first but can lead to a longer cash cycle. And after making a sale, you don’t want your cash to take any longer than necessary to reach your bank account! Fortunately, the right strategy can help you avoid most cash flow obstacles. Here are six of the most common causes surrounding money flowing into your business, plus how to solve them.

Contract Terms

The contracts you have in place play a huge role in establishing positive cash flow. By outlining the expectations of each party, they help prevent conflicts and mitigate risk. But to do so, they need to be solid.

Review your contract terms relating to when and how you will be paid. Look for potential causes for cash flow obstacles and make any necessary adjustments. Are your net payment terms in alignment with when your bills are due? If they’re not, there will be a cash shortage. What about your payment schedules and due dates? If payments are overdue, do you have a late fee in place?

Whatever you decide to include in your contract, use plain and straightforward terms to avoid any confusion.

Manual Invoices and No Automatic Payments

The faster you send an invoice out, the faster you’ll receive payment. Make it as easy as possible for your customers to pay you. The best way to do that? Automation.

Paperwork is a thing of the past. Invoice automation software reduces errors while providing an accurate, real-time report of your cash flow. Even better? It saves time – for both you and your customers. Offer the option to set up automatic payments for customers who have payment plans or monthly charges with you. This creates a win-win for both of you!

No Actual Due Date

Your customers need to know when to pay you, so don’t make them guess. When do you expect payment? If possible, align your invoicing with your customer’s payment cycles to avoid cash flow obstacles.

When you send invoices electronically and request online payments, long payment terms are often unnecessary. And although invoices with very short payment terms are more likely to go past due, you’ll still receive payment quicker than 30-day terms. Make sure all of your invoices have a due date that’s clearly visible.

No Reporting and Manual Follow-Ups

When’s the last time you took a look at your outstanding payments report (also known as Accounts Receivable aging report)? Ask your bookkeeper or accountant to provide you with one each month.

Take a look at how much is owed and who owes it. Send email reminders, monthly statements, or make phone calls to remind your customers that you’re serious about getting paid.

Automating with invoice software makes it easy. The software automatically sends reminders about when the invoice is about to become due and then follows up until payment’s received. Sometimes, the software even notifies you when your customer views your invoice.

Mailed Checks

Leave the postal service for the delivery of greeting cards, not your money. Requesting electronic payments helps you get paid now, instead of in a few days – or weeks. Setup for receiving online payments is easy, affordable, and done in a matter of minutes. There are typically minimal transactional fees, but if you have a lot of transactional volumes, keep an eye on them. When shopping for a service provider, don’t compare only transaction costs – take a look at the level of service that’s included, too.

Since online payments are quick and hassle-free, customers like them, too.

Bank Processing and Clearing Times

Banks take their time to process and clear checks and payments. Depending on your relationship with your bank, the amount of the check, and the standing of the payer’s account, this timeframe can vary.

But, again, you can reduce this time by offering ACH or credit card payments as an alternative to a check.

Need Help Fixing Your Cash Flow Obstacles?

Accelerating your cash cycle and increasing your cash flow may not be easy, but it’s worth it. To get started, request a Financial Health Check with a trusted financial partner. Learn how to identify your cash obstacles, identify weaknesses in your finances, and create solutions so you can achieve your goals.

Many small businesses struggle with understanding their financials and using that information to plan for their business. We help them understand their numbers so that they can make better decisions and have a clear plan for the future. Schedule a consultation to learn more about improving the cash flow for your business.