NextGen Finance Blueprint™

Your roadmap to fix financial problems before they become disasters

You’re in this for the long term. So let’s build like it.

In the NextGen Finance Blueprint™ we diagnose your finances according to our proprietary 5-part Healthy Financial House™ framework that ranges from basic accounting to high-level financial strategy.

The result? A step-by-step roadmap to fix what’s broken so your business is financially healthy and sustainable.

1-on-1 time with a Fractional CFO

to talk through your problems, goals, and questions

Specific roadmap to fix what’s broken – with clear priorities

based on an in-depth look at your numbers and financial structure

Healthy Financial House™ framework

so your financial systems are built to last and scale with you

Know exactly how to get to where you want to be with the NextGen Finance Blueprint™

The NextGen Finance Blueprint™ is a CFO-led deep dive into your finances, conducted from the ground up. Over the course of 3 to 6 weeks, we run a systematic analysis of your financial structure, including your:

- Reporting capabilities

- Accounting software

- Payment and contract processes

- Risk management

- KPIs and performance metrics

- Internal controls to prevent fraud and data loss

- Trends

- Profitability

- Resource management (think cash, debt, and inventory)

- Budgeting process

- Forecasting practices (short-term and long-term)

- High-level strategic planning

Book your NextGen Finance Blueprint™ as a standalone service, or use it as an on-ramp to hiring a Fractional CFO. Either way, you get a roadmap showing you exactly what needs to be fixed and in what order.

And you’ll get it in the form of clear, specific action items, broken down by category and ordered by priority.

Because the last thing you need is another list with a bunch of things to do with zero guidance on what to tackle first and how to actually do them.

Change your perspective

Adopt a clear model for thinking about your money with our 5-part Healthy Financial House™ framework.

Address problems at the source

Stop putting out fires. Start finding what’s sparking them in the first place and fix it.

Get a manageable action plan

Take away a roadmap that makes progress seem simple: “Do this. Then this. Then this.”

You can’t plan for your financial future when you’re playing crisis whack-a-mole all day long.

It’s the curse of success: you’re so busy meeting demand that you have no time to focus on building your business. So you end up trapped in a constant state of emergency.

Life in Crisis Mode

- Spending days piecing together data that turns out to be garbage you can’t use

- Making decisions on gut instinct alone and losing sleep over it

- Being frustrated that “you don’t know what you don’t know”

- Building systems on-the-fly and then scrambling when things break

- Telling yourself “this is fantastic” while feeling completely overwhelmed by the growth you created

Piecemeal problem-solving won’t cut it.

You need to step back and see the whole structure.

Bouncing from meltdown to meltdown is killing you.

But to fix it, you need a few things:

- A process you can commit to so that progress takes priority

- An expert who can identify the issues you haven’t been trained to spot

- A framework that breaks you out of the scattered approach you’re stuck in

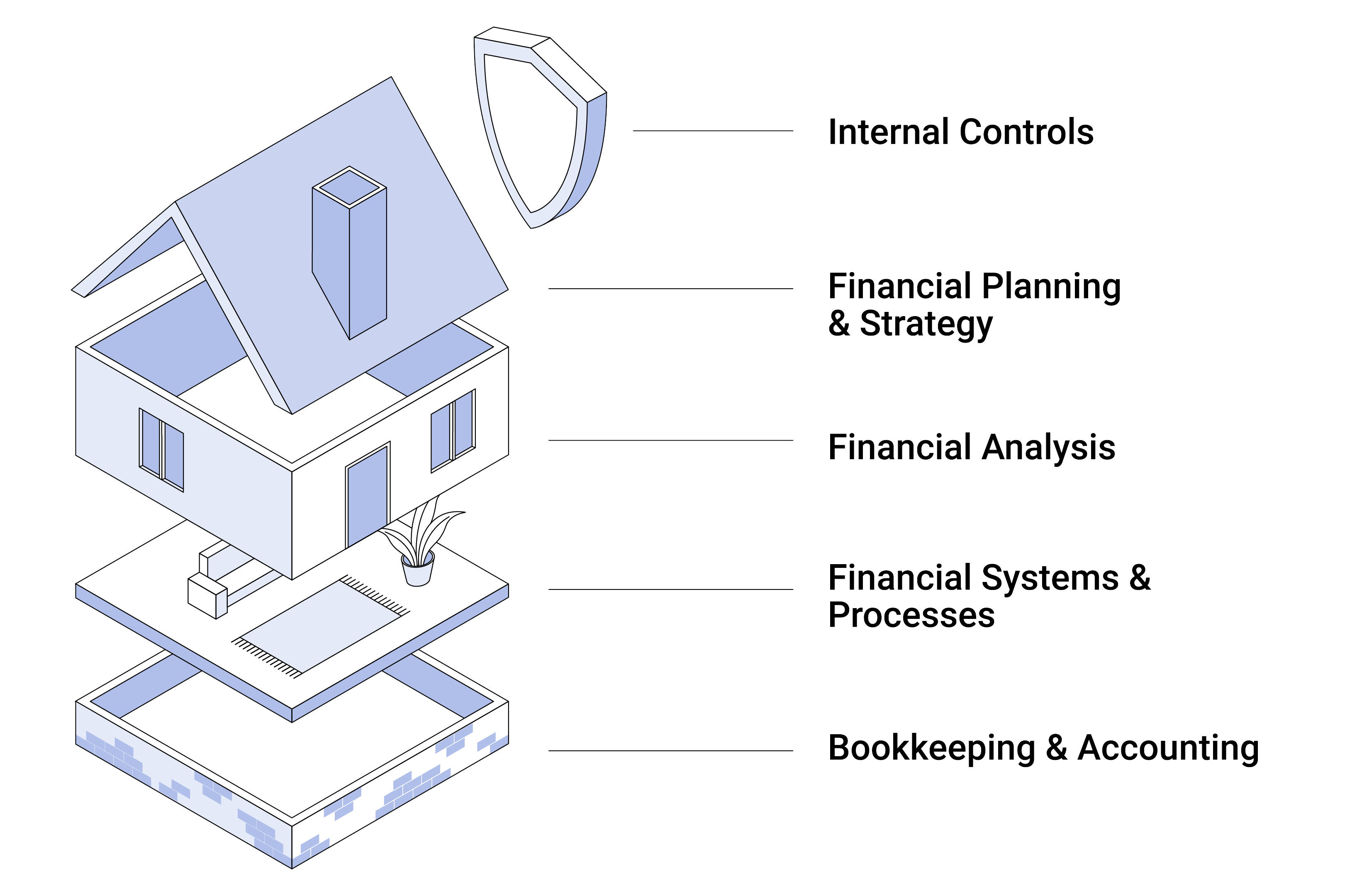

Meet the Healthy Financial House™ framework

The 5-part financial blueprint for building a healthy and sustainable business

When you get a NextGen Finance Blueprint™, you get an in-depth breakdown of your business’s financial structure across 5 carefully chosen categories.

We call this method the Healthy Financial House™ framework.

The beauty of the framework is that it also reveals the entire picture of what’s really happening in your business – because everything that happens in your business eventually shows up in your finances.

The framework helps you see not just the financial symptoms, but what’s actually causing them so you can fix the root causes instead of just treating the symptoms.

Watch NewCastle Finance founder Kathy Svetina break down her Healthy Financial House™ framework.

To learn more about each aspect of the Healthy Financial House Framework™, click on the green circles next to the item.

The Foundation

First things first: let’s make sure you’re properly recording your transactions. Because we can't run analysis on numbers we don’t trust.

- Confirm you’re collecting timely and accurate info

- Make sure you can access data easily on a regular basis

- Start transitioning from cash to accrual accounting

The Interior Design

Most small businesses struggle to collect financial data smoothly. Let’s straighten out your systems so you’re always looking at up-to-date info.

- Get onto the right accounting or CRM software

- Clean up your payment and contract processes

- Find the reporting bottlenecks that block you from making data-driven decisions

The Walls

Do you sometimes struggle to interpret your numbers? After we’re finished, you’ll be able to tell what’s happening at a glance.

- Find out which KPIs you should regularly monitor (and which numbers you can mostly ignore)

- Uncover any potentially dangerous financial weaknesses

- Spot trends that can help you plan for where you’re headed

The Roof

Set your objectives. Design plans to achieve them. This is how we map out the future of your business.

- Assess how you’re managing resources like debt, cash, and inventory

- Review best practices on creating budgets and forecasts

- Learn how to set up annual strategic planning habits to chart your direction

The Security Alarm

Prevent a disastrous setback by guarding against fraud, abuse, and data loss. (Small businesses often underestimate this threat.)

- Add checks and balances to your bookkeeping to prevent manipulation

- Check your data backup practices so that a failure won’t be catastrophic

- Adopt proper auditing so you can catch mistakes and abuse before they snowball

Walk away with a step-by-step roadmap that shows you exactly what to fix and in what order

Your NextGen Finance Blueprint™ includes

- Comprehensive diagnostic across all 5 areas of your financial structure, showing you exactly where you are now and where you need to be based on your goals

- Prioritized action roadmap with specific recommendations ranked by importance so you know what to tackle first, second, and third

- 90-minute strategy session to walk through your roadmap, answer your questions, and decide whether to implement solo or with guidance

Advantages of the Healthy Financial House™ framework

See the full picture

The 5-part structure helps you finally look at your finances holistically. And that perspective shift is permanent: you’ll think more clearly about your finances from now on.

Understand your money in your terms

The framework uses language and concepts that make sense whether you ‘love getting nerdy with the numbers’ or prefer to stay high-level – you’ll get clear direction on what actually matters

Make high-impact improvements first

Because we start our analysis with the basics and work our way up, it’s easy to spot the no-brainer fixes you should make right away.

Build for the long-term

The 5 basic pieces of a healthy financial structure don’t change whether you’re at $10M or $500M. So putting them in place now will serve you no matter how big you grow. And the earlier you do it, the easier it is to get it right.

How it works

1

Diagnostic call

Spend 90 minutes discussing your finances with Fractional CFO Kathy Svetina to identify your main challenges, goals, and priorities.

2

Deep dive into your finances

Over the next 3 to 6 weeks, we delve into your numbers, systems, and strategy to uncover your biggest opportunities.

3

Roadmap delivery and a wrap-up call

You receive a full roadmap complete with prioritized recommendations. Afterward, we hold another 90-minute call to review your results, clarify next steps, and answer your questions.

Remember: the longer you wait, the more expensive the fix becomes

Overhauling your finances may seem like a lot. But just imagine how much harder it will be to alter your financial structure after building on top of it yet another year.

The whole point of the Healthy Financial House™ framework is to identify what needs to be in place so your financial systems work for you instead of against you.

So by building the structure correctly now, you’re not just getting the power to make smarter, more confident decisions, you’re avoiding the much more painful and expensive process of fixing problems when a disaster finally forces you to fix it.

Click below to get started with your

NextGen Finance Blueprint™

$9,500 flat-rate pricing

Standalone service, or on-ramp to a Fractional CFO

Consultation required to book. All NewCastle Finance clients must have a NextGen Finance Blueprint™ done before further advisory services begin.

Resources

© 2019-2025 NewCastle Finance LLC. All Rights Reserved.